No federal income tax withheld on paycheck 2020

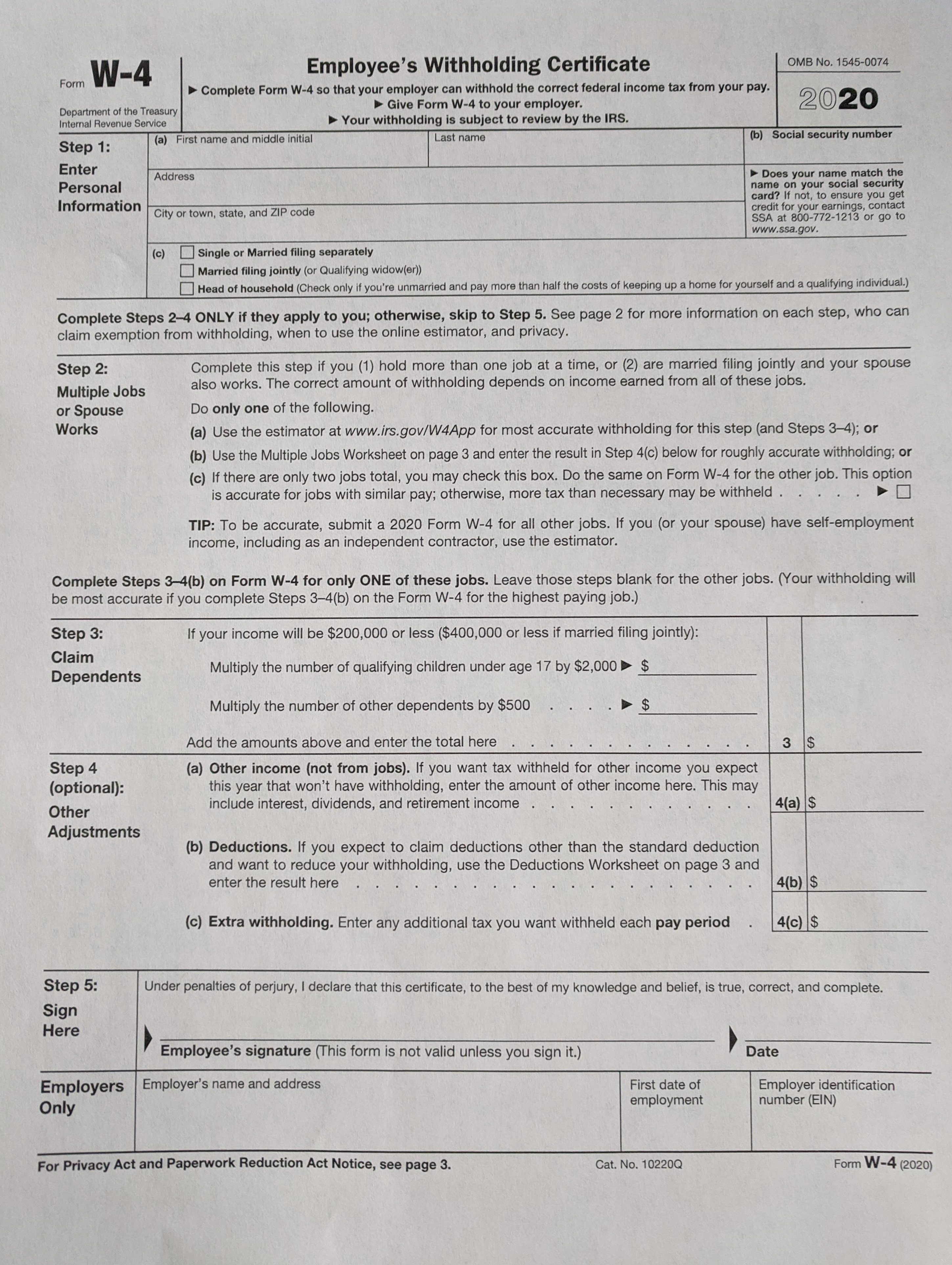

To be exempt from withholding both of the following must be true. They are all using the 2020 W-4 form.

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

For employees withholding is the amount of federal income tax withheld from your paycheck.

. Use this tool to. See how your refund take-home pay or tax due are affected by withholding amount. The following are aspects of federal income tax withholding that are unchanged in 2021.

Withholding is not being calculated even though I entered the dollar amount for the 2020 W4. So if your total tax on Form 1040 is smaller than your. If you see that your paycheck has no withholding tax it could be because you are exempt.

The Federal Income Tax is a tax that the IRS Internal Revenue Services withholds from your paycheck. Estimate your federal income tax withholding. You expect to owe no federal income tax in the current tax year.

2020 W4 federal withholding not calculating. I have downloaded new payroll tax. For example for 2021 if youre single and making between 40126 and.

It eliminates allowances entirely and instead estimates taxes as dollar amounts. Taxpayers will pay a lower federal withholding rate and at the same time claim more allowances. The percentage of tax withheld from your paycheck depends on what bracket your income falls in.

The federal withholding taxes are not calculating for some of our employees. Your employer is responsible for withholding taxes from your check based on the Form W-4 he has on file for you. Why Was No Federal Income Tax Withheld From My Paycheck 2020.

Why is no federal tax withheld from 2020. The amount of income tax your employer withholds from your regular pay. The IRS made changes to the.

Between 2020 and 2021 many of these changes remain the same. Up to 15 cash back The reason that you have an actual TAX LIABILITY has nothing to do with withholding but rather what your actual tax bill is of zero is that with an. Employees Withholding Certificate goes into effect on January 1 st 2020.

I have entered the information off that correctly. Nonetheless the 2020 W-4 changes accommodate these expenses. Solved If no federal income tax was withheld from your paycheck the reason might be quite simple.

Reason 1 The employee didnt make enough money for income taxes to be withheld. How It Works. If you claimed tax exemption on your W-4 form no federal income tax is withheld.

This tax will apply to any form of earning that sums up your income. The new form called Form W-4. The IRS and other states had made sweeping.

January 24 2021 405 PM. Tax exemption is the opposite of claiming zero allowances on your W-4 but you must meet certain requirements before you have no federal taxes taken out of your paycheck.

Why No Federal Income Tax Was Withheld From Your Paycheck

How Do I Know If I Am Exempt From Federal Withholding

Paycheck Taxes Federal State Local Withholding H R Block

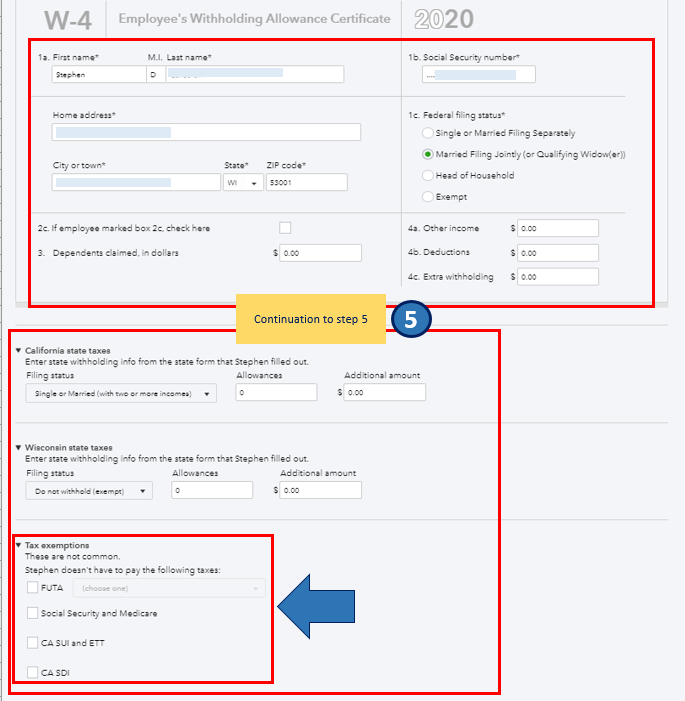

Back Office Tax Tools Tax Set Up 2020 Tax Set Up Tabs Support Center

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

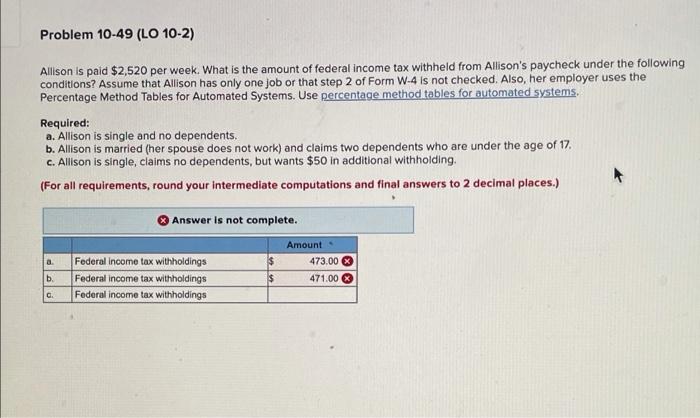

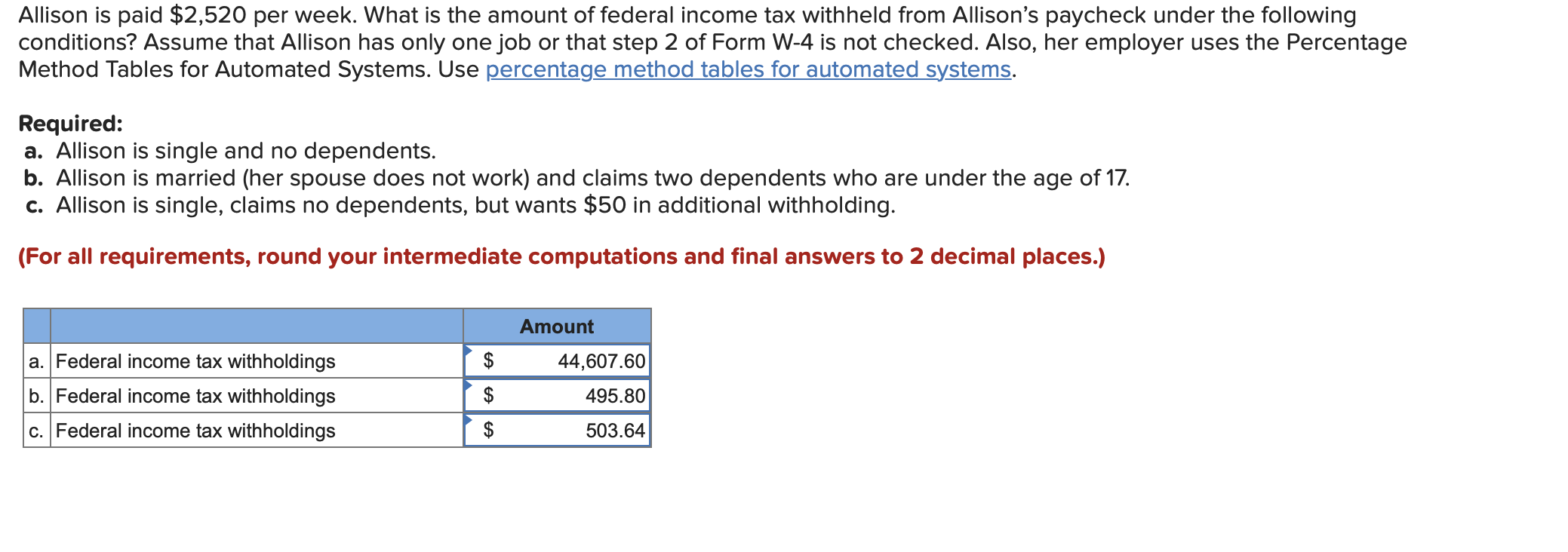

Solved Problem 10 49 Lo 10 2 Allison Is Paid 2 520 Per Chegg Com

New In 2020 Changes To Federal Income Tax Withholding Tilson

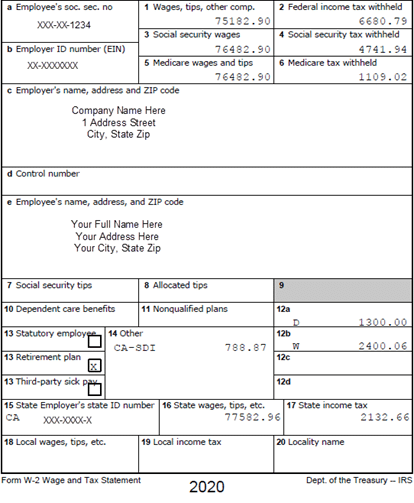

Understanding Your W2 Innovative Business Solutions

New 2020 Form W 4 Answerline Iowa State University Extension And Outreach

Solved Federal Witholding On New Employees Is Not Being Taken Out

There Are No Federal Taxes Being Taken Out Of Our Employees Paychecks The Most Hours Worked On A Paycheck Is 20 Hours Can Someone Help Me Understand

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Calculate Federal Income Tax

Solved Allison Is Paid 2 520 Per Week What Is The Amount Chegg Com

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

Decoding Your Paystub In 2022 Entertainment Partners