Mileage refund calculator

Ad Auto-track work miles with our mileage calculator for tax deductions or reimbursement. If you made 26 monthly payments of around 400 then 26x400 10400.

Free Mileage Reimbursement Form 2022 Irs Rates Pdf Word Eforms

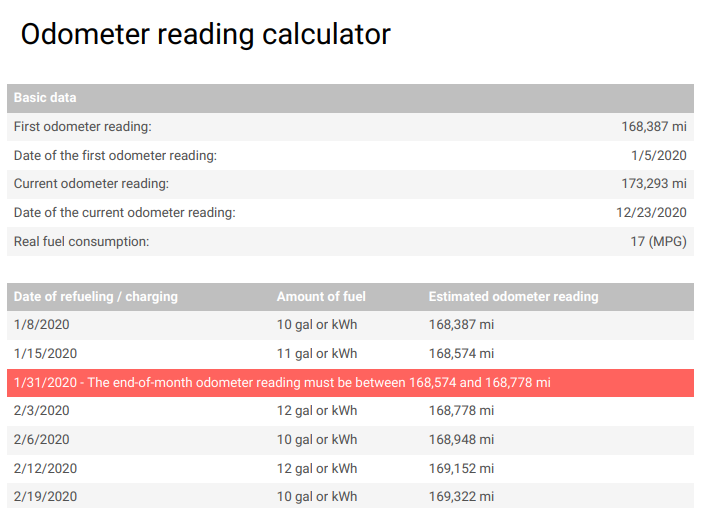

An easy way to calculate gas mileage is to remember the odometer reading or to reset the mileage counter when filling up a gas tank.

. Over the nine months. Calculate gas mileage using trip distance. -Fuel Rate - fuel cost per mile or kilometer.

To get a specific figure you need to check which of your work journeys are eligible for tax relief by considering things like if youre going to a temporary workplace and which mileage rate applies. The average mileage expenses rebate made with RIFT Tax Refunds is worth 3000. 25p per mile after that.

For example if you drove your vehicle 1000 miles for IRS-approved business purposes in 2021 multiply 1000 miles x 056 per mile. Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes. Enter the fuel price per gallon or per liter and the calculator will calculate.

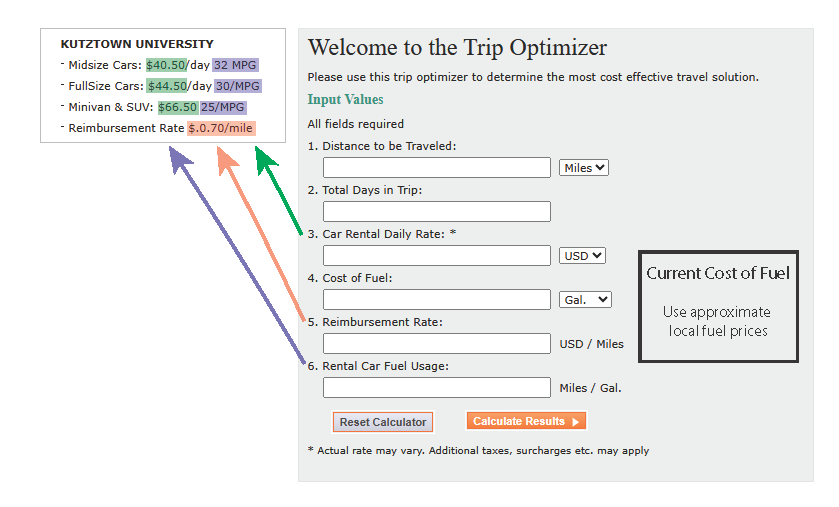

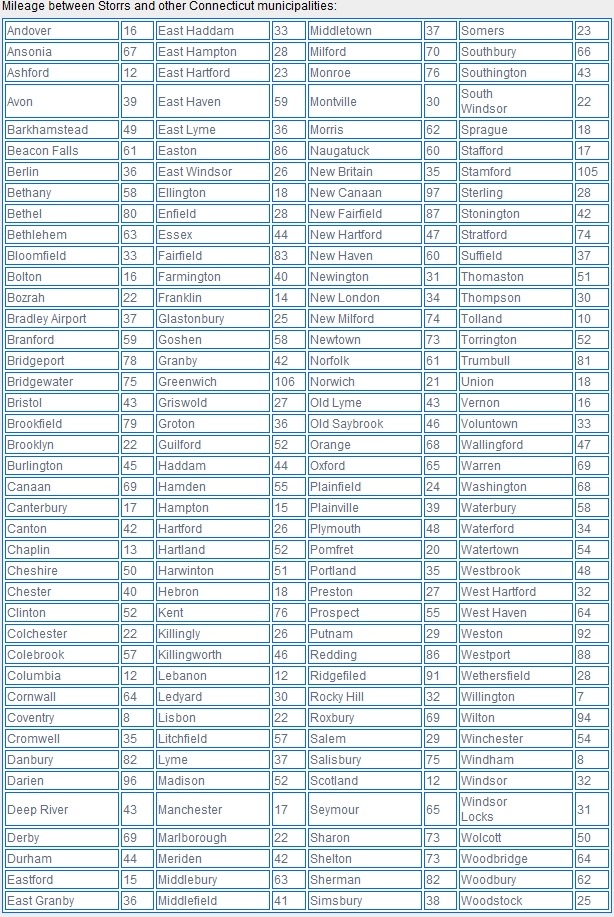

To use our calculator just input the type of vehicle and the business miles youve travelled in it for work. Keep records of the dates and mileage of your work journeys add up the mileage for each vehicle type youve used for work take. Type the location name in the From and To fields.

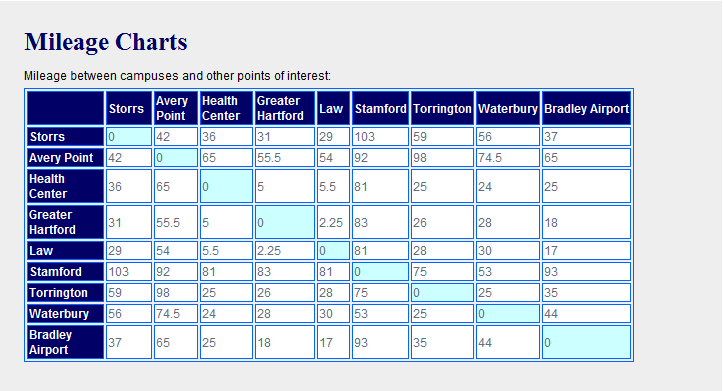

Read more information about car running costs in our driving advice section. Click the search button to show the reimbursable mileage that should be reported in your monthly FMS iExpense report. Enter total distance and the amount of fuel used for the trip.

To achieve this maximum 18 refund youd need to have driven 0 miles over this nine-month period. The Rand McNally mileage calculator will help you determine the mileage between any two destinations. Where a one-way trip includes multiple flights and a stopover or break in journey change in cabin class or multiple airlines the number of Points required will be higher1.

For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year. Then you multiply them by the correct mileage rate. 45p per mile for the first 10000 miles you travel in a year.

Routes are automatically saved. The Business Mileage Calculator gives you an estimated amount of business mileage tax rebate that you could be owed. Use the following mileage calculator to determine the travel distance in terms of miles and time taken by car to travel between two locations in the United States disregarding traffic conditions.

To work out how much you can claim for each tax year youll need to. Cars and vans after 10000 miles. When doing so next time obtain the mileage accrued between the two gas fill-ups.

Select the location from each drop down. Then divide the mileage figure by the amount of gas filled the second time to obtain the gas mileage. 0 miles driven 9000 lower than estimated 18 refund 3000 miles driven 6000 lower than estimated 12 refund 6000 miles driven 3000 lower than estimated 6 refund 9000 driven exactly as estimated 0 refund.

More than 1 000 000 users use the Driversnote no hassle mileage tracker - join today. Cars and vans first 10000 miles. Enter 10400 below Cash Price of Vehicle as listed on Purchase Lease Agreement Mileage of first attempt for repeated safety issue If vehicle was purchased used subtract mileage that was attributed to the vehicle by previous owner from Mileage of first repair for safety issue.

The number of Points displayed above are the minimum number of Points required on the most direct routes. Price per Gallon or Liter. Youll be able to deduct 560.

For a location missing from the drop down type a street address including city in the field. Enter your route details and price per mile and total up your distance and expenses. To use the standard mileage rate for a car you own you need to choose this method for the first year you use the car for business.

56 cents per mile driven for business use down 15 cents from the rate for 2020 16 cents per mile driven for medical or moving purposes for qualified active duty members of the Armed Forces down 1 cent from the rate for. Many people dont realise that its not something HMRC will automatically give back to you you have to claim it back - and know what youre claiming. You can improve your MPG with our eco-driving advice.

So the new standard mileage reimbursement rates for the use of a car also vans pickups or panel trucks from on January 1 2021 will be.

Past Odometer Reading Mileage Calculator Irs Proof Mileage Log

Vehicle Mileage Calculator Kutztown University

Irs Mileage Rate For 2022

2021 Mileage Reimbursement Calculator

Mileage Log Template Free Excel Pdf Versions Irs Compliant

Mileage Reimbursement Calculator Mileage Calculator From Taxact

Use Our Rate Calculator To Budget For Mileage Reimbursement Costs

How To Calculate Your Mileage For Reimbursement Triplog

Mileage Calculator Credit Karma

Mileage Calculation Accounts Payable

Use Our Rate Calculator To Budget For Mileage Reimbursement Costs

Mileage Calculation Accounts Payable

How To Calculate Your Mileage For Reimbursement Triplog

Mileage Reimbursement Rates What You Need To Know Tax Alert June 2021 Deloitte New Zealand

Mileage Reimbursement Calculator

Smart Mileage Calculator For Vehicle Users Mileagewise

How To Calculate Your Mileage For Taxes Or Reimbursement